SEPTEMBER 2024

Understanding Residential Aged Care Fees

Residential Respite

For residential respite care, short stays up to 63 days per each financial year) payments include:

- A Basic daily fee currently is $63.57.

Types of Care Fees

Residential aged care fees are made up from a combination of the Basic Daily Care Fee and the Means Tested Care Fee.

Basic Daily Care Fee

Every Resident in aged care, regardless of their level of assets and wealth is required to pay a mandatory flat fee towards their care. This is a fee set by the government and will never cost more than 85% of the Australian Age Pension. The fee amount is reviewed twice a year in line with increases in the Age Pension and changes in the cost of living.

Think of this fee as the same as paying your utility charges at home. The Basic Daily Care Fee covers the cost of expenses such as meals, power, heating and air conditioning, water, laundry, and room cleaning.

Means Tested Care Fee

The Means Tested Care Fee is only paid by people who can afford to contribute more towards the cost of their personal and clinical care. This is an additional fee towards the cost of care that is based on an assets and income test determined by the Department of Health and Human Services.

An annual and lifetime cap is applied to the Means Tested Care Fee to protect residents who receive care for longer than the average period. Once the fee has been paid to its capped annual amount, nothing more is required to be paid until the start of a new year. Means tested care fees paid during previous home care or previous permanent residential care stays also count towards the annual and lifetime caps.

Currently the Maximum Means Tested Care Fee that a resident can be asked to pay per year is $34,174.16, with a lifetime limit of $82,018.15.

Accommodation Payments

The accommodation payment is determined by the aged care home, which is why each provider will charge differently depending on the size of the property and quality of amenities.

Types of Accommodation Funding

How much you contribute to the cost of your accommodation will depend on your financial situation and eligibility for government assistance. Your accommodation can be:

- Fully Supported

- Partially Supported

- Fully self-funded

Fully Supported

When your income and assets are below a certain amount, all your accommodation costs are paid by the Australian Government. Some rooms available for residents with reduced financial means. Residents with assets under $61,500 and income less than $33,735 (including your age pension) may obtain funding from the Australian Government.

*income includes age pension and any other income streams

*Assets include car, contents and financial assets, account-based pension

*A resident’s supported position is subject to change if their asset position alters

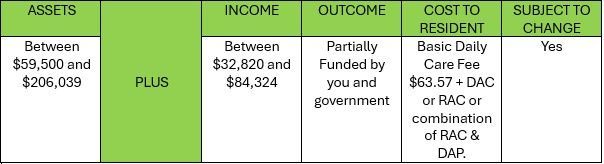

Partially Supported – RAC/DAC

If you are eligible for some Australian Government assistance, you will be required to pay a

contribution towards your accommodation costs. Your contribution can be made as a lump sum

(RAC), daily amount (DAC), or a combination of both.

The lump sum payment you put towards your accommodation costs is called a Refundable

Accommodation Contribution (RAC), while the government covers the balance of the amount. The

RAC amount is fully refundable when you leave the aged care home.

The Daily Accommodation Contribution (DAC), unlike the RAC, is not refundable. The DAC is like

paying rent, whereby regular payments are made over time. While the DAC is also partially funded

by the government, it requires less money upfront.

If your assets exceed $59,500 and your income exceeds $32,820 (including your age pension), the

Australian Government will fund some of the cost of your accommodation while you pay for the rest

in the form of a Daily Accommodation Contribution (DAC)

*income includes age pension and any other income streams

*Assets include car, contents and financial assets, account-based pension

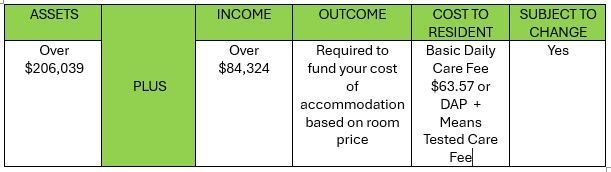

Fully Self-Funded

If your assets exceed $206,039 and your income exceeds $84,324 you will not be eligible for

government funding and you will be required to cover the entire cost of your accommodation.

*income includes age pension and any other income streams

*Assets include car, contents and financial assets, account-based pension

Similar to being partially supported, you can choose to pay for your accommodation as a lump sum

(RAD), daily amount (DAP) or a combination of both.

The Refundable Accommodation Deposit (RAD) is a lump sum payment for the entire cost of your

accommodation. Different types of rooms in an aged care home can have different RAD amounts.

The RAD is fully refundable to you, or your estate, when you leave the aged care home. The

Australian Government guarantees the repayment of the RAD. RADs are also an exempt asset for

pension purposes, and it offsets the interest cost of the DAP.

While it is more money upfront, the full lump sum RAD is cheaper overall than the DAP, since the full

lump sum RAD is not subject to any interest rates.

Instead of paying for your room up front in lump sum, you can choose to pay the Daily

Accommodation Payment (DAP). This payment is the interest payable on an unpaid and calculated

as a daily payment.

How to calculate the DAP/DAC:

The government sets the Maximum Permissible Interest Rate (MPIR) and the DAP is simply interest

applied to any unpaid RAD. The MPIR applicable for the resident during their stay is the MPIR that is

applied at the date of permanent entry into care. The MPIR is subject to change on the 1st of

January, April, July and October each year. Currently, the MPIR is 8.15%.

As an example, if the RAD is $550,000 and you can contribute $200,000, then the DAP would be

calculated as:

DAP = (RAD – Deposit) x MPIR 8.36% / 365 days

DAP = (550,000 - $200,000) x 8.36% / 365 days

DAP = (350,000 x 8.36%) / 365 days

DAP = $29,260 / 365 days

DAP = $80.16 per day

Combination of RAD and DAP Payments

You may not have the means to pay the RAD in full or you do not want to sell your home. In that

case, you can make a combination of RAD and DAP payments. The higher the contribution made

toward the RAD payment, the lower your daily fee will be.

When do I pay the RAD and DAP?

As a new resident, you will have up to 28 days from entering the home to decide what combination

of payments you would like to make. If you choose to pay the RAD, you then have up to six months

to pay.

The accommodation pricing is also available on our website and on the My Aged Care website at: